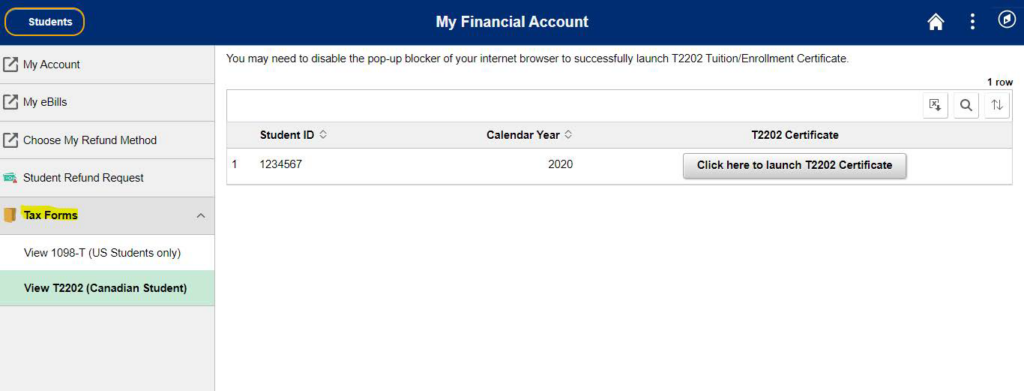

T2202 – Tuition Enrollment Certificate

Student Tax Information

The federal T2202 tax form is designed for all students who paid tuition fees for qualifying courses that they are eligible to claim on their income tax return. It is used to certify a student’s eligibility for their tuition amount.

T2202 (Tuition and Enrolment Certificate) is issued to students who paid eligible tuition and fees for qualifying courses that can be claimed on the income tax return. The form shows the eligible tuition fees paid as well as the months you were enrolled either part-time or full-time.

YES! You must have a Social Insurance Number (SIN). Please refer to the Canadian Government website for details on how to apply for your Social Insurance Number (SIN).

Once you have a SIN, follow the below instructions:

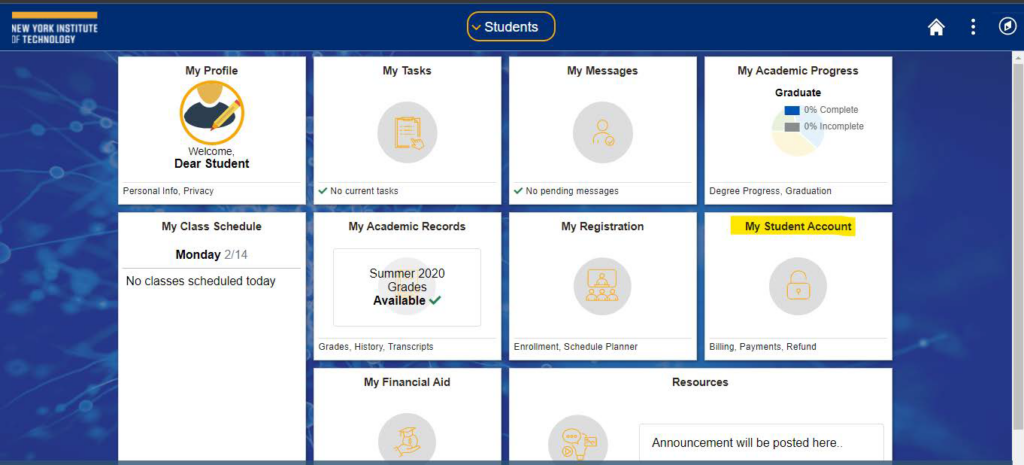

- Log in to the Student Service HUB.

- Under the Personal Information Section, click “Update SIN (Canadian Students).”

- Add your SIN with or without dashes in both fields and click “Submit.”

- You will receive a confirmation message stating that your SIN has been updated.

NO! Once your T2202 is issued from the system, New York Tech is not able to update any information on your T2202 tax slip. Students are responsible for updating their personal information following the below steps if there are any changes:

- Log in to the Student Service HUB.

- Click on “Update Address” under the Personal Information Section.

Please contact Vancouver.Bursar@nyit.edu for your inquiry.